6 Explain the Difference Between Fixed and Variable Costs

It is based on the distinction between fixed and variable costs. Another example of mixed or semi-variable cost is electricity bill.

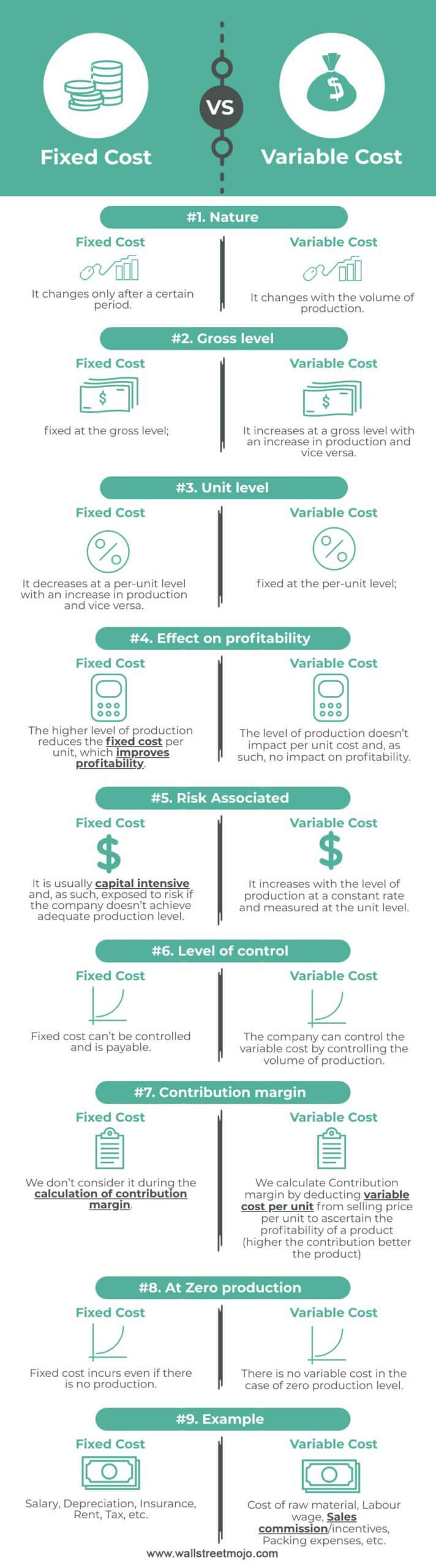

Fixed Cost Vs Variable Cost Top 9 Best Differences Infographics

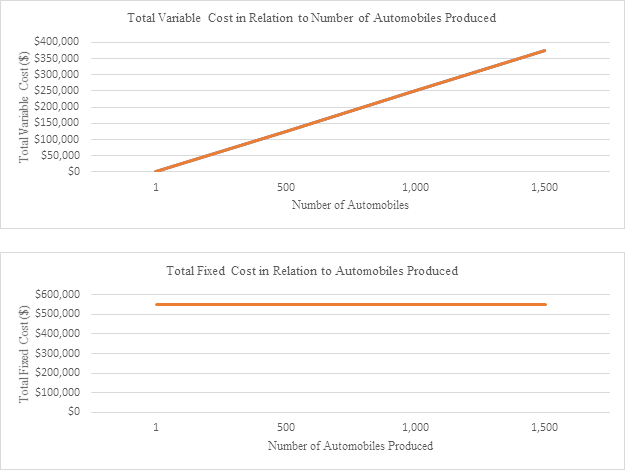

A variable cost is a type of cost that changes when there is a rise and fall in a companys production volume.

. Fixed costs are ignored and only variable costs are taken into consideration for determining the cost of products and value of work in progress and finished goods. Why Is It Important to Distinguish Between Fixed Costs and Variable Costs. The firms annual sales are 400000.

Variable costs change based on the amount of output produced. A fixed cost is a cost that remains constant in total regardless of changes in the level of the activity. For example if your average annual fixed costs are 60000 the average per unit sales price is 5 and the average per unit variable cost is 280 you will need to 136365 in gross sales.

You will always have fixed costs even if you dont sell much. Fixed and variable costs also have a friend in common. It is time-dependent and changes after a certain period of time.

The best examples of a fixed cost can include costs such as rent electricity bill machinery and the buildings. Variable costs can be easily managed as opposed to fixed costs as variable costs are in direct relation to production levels whereas fixed costs are not. The best examples of variable costs include payments made to the employees utilities and materials that are being used.

The 500 per month is a fixed cost and 5 per hour is a variable cost. A variable cost per unit is constant Ex. Every business has certain fixed costs regardless of production.

Variable cost includes direct production direct selling purchase of raw materials transportation labour costs etc. Its fixed assets are 100000. Variable costs are those costs which change with a change in the volume of production.

Fixed costs vs variable costs vs semi-variable costs. In short due to fall in. Fixed costs stay the same no matter how many sales you make while your total variable cost increases with sales volume.

If sales are high your variable costs increase. In the short-run when production is temporarily stopped there will be. A fixed cost does not change whether there is an increase or decrease in the quantity of goods and services produced.

Variable costs are the ones who constantly keep on changing with the amount of material being produced or sold. Variable cost is referred to as the type of cost that will show variations as per the changes in the levels of production. Because these fixed costs remain the same throughout the year theyre easier to budget for.

However because theyre not related to the volume of production or operations theyre. Constituents of fixed cost include fixed production fixed selling and fixed administrations. It is the total of variable cost ie prime cost plus variable overheads.

For example the rental charges of a machine might include 500 per month plus 5 per hour of use. Trimming variable costs on the other hand requires actively making multiple decisions every day about whether or not to buy certain items or participate in specific events. Conversely Variable cost refers to the cost of elements which tends to change with the change in level of activity.

Fixed costs are expenses you must pay to run your business. Thus fixed costs are incurred over a period of time while variable costs are incurred as units are produced. FG132960673 Questions Q1.

Caltrate Company follows a moderate current asset investment policy but it is now considering a change perhaps to a restricted or maybe to a relaxed policy. Generally your fixed expenses will stay the same from month to month. Fixed cost and variable cost are the two components of total cost.

The key points of difference between fixed and variable cost have been detailed below. Let us examine the main points of distinction in fixed costs and variable costs. An activity base units produced miles driven etc.

Taken together fixed and variable costs are the total cost of keeping your business running and making sales. Variable costs may include labor commissions and raw materials. Fixed cost is regular as it needs to be paid to sustain the company while variable cost is incurred as per the productivity of a company.

Fixed Costs can Never be Zero. However both variable costs and fixed costs need to be constantly evaluated and managed in order to ensure that they in some correspondence to production levels ensuring that a profit can be made. Fixed costs are constant costs which are incurred irrespective of the volume of production achieved.

This difference is a key part of understanding the financial characteristics of a business. Fixed cost is referred to as the cost that does not register a change with an increase or decrease in the quantity of goods produced by a firm. The main difference is that fixed costs do not account for the number of goods or services a company produces while variable costs and total fixed costs depend primarily on that number.

The difference between fixed and variable costs is that fixed costs do not change with activity volumes while variable costs are closely linked to activity volumes. While working on costs of production one should know the difference between fixed cost and variable cost. Rent Relevant range of activity for a fixed cost is where the cost is flat on a graph.

Fixed costs are one that do not change with the change in activty level in the short run. The difference between fixed and variable costs is that fixed costs do not change with activity volumes while variable costs are closely linked to activity volumes. A cost that has the characteristics of both variable and fixed cost is called mixed or semi-variable cost.

Fixed costs remain the same regardless of production output. Variable costs change in direct proportion to the changes in volume or business activity level. On the other hand variable costs fluctuate based on your sales activity.

Then you divide an average of your annual fixed costs by the sum of 1 minus the average per unit variable cost divided by the average per unit sales price. Trimming a fixed cost like your cell phone plan insurance or your cable package requires only making a decision once and then living with that decision for the next several months or years. Its target capital structure calls for 50.

Break-Even Analysis The knowledge of the fixed and variable expenses is essential for identifying a profitable price.

Fixed Cost Vs Variable Cost Top 9 Best Differences Infographics

Fixed And Variable Costs Overview Examples Applications

Fixed And Variable Costs Overview Examples Applications

Fixed Cost Vs Variable Cost Top 9 Best Differences Infographics

Comments

Post a Comment